Credit Smart

Unit 3: Understanding Your Credit Score

When it comes to getting a loan, it’s your credit score that is used to determine interest rates. The most common scoring system, Fair, Isaac and Company (FICO), is used among all creditors and credit bureaus; most creditors and credit bureaus either use the FICO scoring system or have a system based on the FICO model.

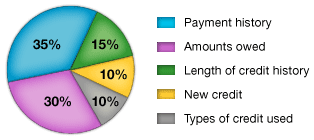

Factors Used to Calculate Your Credit Score

A credit score is a number that reflects your ability to manage credit—or the risk involved in making a loan. In understanding how scores are calculated, we will review the FICO Beacon score and factors used to calculate your credit score; the same factors are used in all three models.

FICO Scoring Range 300-850 Points

- 300 Baseline Points

- 193 Payment History

- 165 Outstanding Debt

- 82 Credit History

- 55 Credit Inquiries

- 55 Types of Credit

= 850 Total Points

Improving Your Credit Score

Credit scoring is not static, it changes monthly. Even if you have poor credit or are looking to rebuild your credit, following a few simple steps can improve your credit score. The secret is in understanding how scores are calculated. Here are some things that can help you build a strong credit history and improve your credit score:

- Payment History: Always pay credit cards or other loan payments on time. One late payment can drop your score as much as 20 points.

- Outstanding Balances: Reduce your debt amount. Never carry more than 35% of your outstanding card balance.

- Credit History: Pay off your credit cards rather than transferring balances. Do not close accounts older than 7 years that are in good standing—it will lower your score. And do not open and close accounts, it will hurt you score.

- Credit Inquiries. Do not sign up for credit offers that you do not plan to use. More than 4 inquiries in a 3 month period will lower your score.

- Types of Credit. Having both an installment loan and a revolving loan will help build credit. Do not have more than 1-3 revolving accounts or credit cards.

According to FICO, here are a few examples of what can increase your score:

- Paying your bills on time for 6 months. This could raise your score more than 20 points. If your FICO score is 690 it is now 710.

- Paying down the balances on your credit cards by 35%. This could raise your FICO score more than 20 points. If you owe $2230, paying $780 alone will raise your score.

Decrease your scores by:

- Missing monthly payments. Not making payments on time could decrease your score by 75-125 points. If your FICO score is 650, it will now lower to 575.

- Maxing out your credit cards. If you are close to your credit limit, your score could decrease 20-70 points. If your FICO score is 650, it will now be 580.